In this post I will show you how to create your own custom Squawkbox in NinjaTrader which will monitor key order flow events and price action for you, across multiple markets. This will help you anticipate price swings in your traded markets and give you an extra set of eyes when monitoring the order flow for changing market conditions and abnormal trading activity.

— Jump to NinjaTrader Squawk-Box configuration

Recently a long time proprietary trader put it this way to me:

What this means is that a move in one market is very often preceded by a move, or order flow event in another market. For example, if you are trading Bund futures in the European afternoon, a lot of the moves you observe are in correlation with the US financial futures such as the 10 Year Treasury Note (T-Note). Identifying abnormal buying or selling activity in the T-Note can give you an edge when working orders in the Bund. The T-Note is also heavily ‘spread’ with other markets, so you could monitor for buying / selling patterns in the T-Bond for instance as well as the T-Note (NOB spread) for market moving causes in the Bund and so on.

You can take this concept to Equity futures, and monitor for large trades across the calendar spread, hedge trades in specific sectors, or abnormal stock market investing activity in heavily-weighted stocks in the index such as Apple. All the necessary market information is accessible for the retail trader to take advantage of correlated market events, however

Professional traders and prop traders will at minimum have access to a professional squawk-box service for reporting on abnormal market activity such as OTC (over-the-counter) transactions, and usually receive alerts on their screens and announcements for relevant market movers, and some firms go as far as providing a support team for monitoring correlated market events for keeping their traders informed. So where does this leave day-traders trying to make a living from their home office?

Well you can either join, or be trained by a prop firm that provides these services, pay for professional grade services such as a Bloomberg terminal and an institutional squawkbox, or configure your own custom squawkbox audio feed using PriceSquawk to monitor for potential market moving trading activity and price action across any number of correlated markets . Here are some suggestions for setting up your PriceSquawk squawkbox in NinjaTrader:

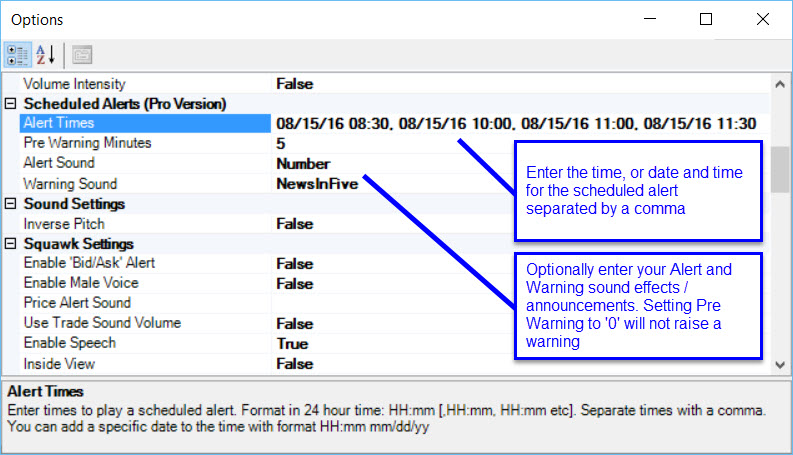

Configure Scheduled Number Releases

It is essential for day-traders to know when key numbers are going to be released. Holding through one NFP announcement for example, can result in you losing your entire month’s profits or more if on the wrong side of the trade. I like to start the week by scheduling alerts for all market focus releases scheduled on the Bloomberg Economic Calendar. To do this in NinjaTrader open a PriceSquawk window. Then select from the Misc menu ‘Options’ and navigate to ‘Scheduled Alerts’ to enter your alert times (and dates).

PriceSquawk Tip: Time can be entered at the second level using HH:MM:SS format. If you do not enter a date then the alert will be raised daily at the scheduled time. The default warning sound is ‘News in one minute’ 1 minute prior to the time, and ‘Number’ announced at the scheduled time.

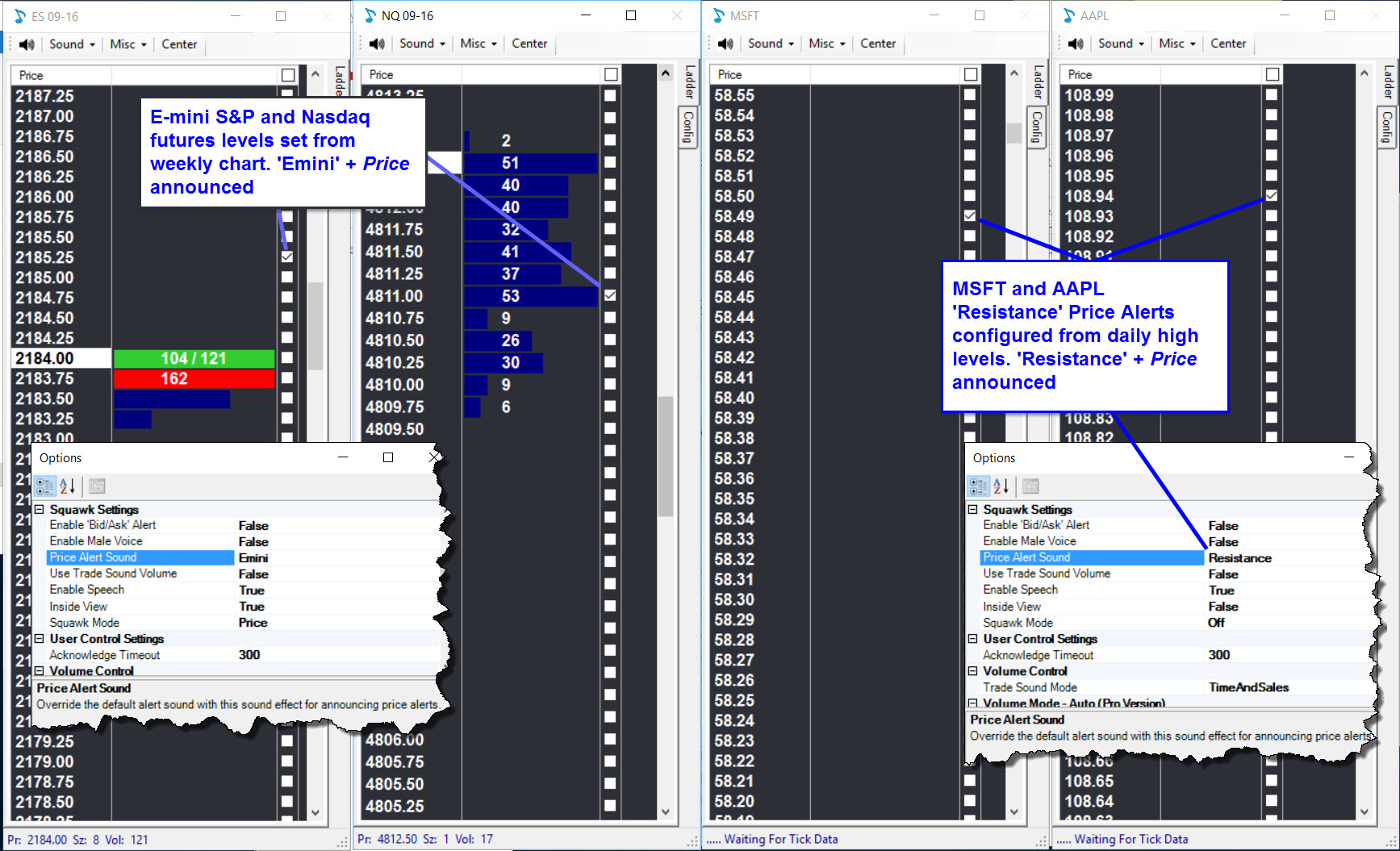

Add Key Price Level Alerts

For each market you are monitoring it helps to be reminded of key levels that all market participants are watching. PriceSquawk lets you easily configure price alerts checking a box at the relevant price level. With the PriceSquawk Squawk Mode enabled, descriptive price alerts will be announced e.g. ‘Emini’ + Price or ‘Price Alert’ + Price. For example you may want to configure price alerts for obvious levels on a daily, weekly and monthly price chart in each of the E-mini S&P 500’s and Nasdaq futures for a broader market perspective, as well as in major stock components for the indices.

PriceSquawk Tip: For simplified price alerts disable Squawk mode from the Sound Menu and enable ‘Trade Sounds’ then select a unique price alert sound effect as your ‘Alert Sound’ on the Config tab

Monitor Order Flow Across Multiple Markets

We so far have a market squawk that will keep us alert to scheduled number release events and also announce major market levels across a range of related markets. Now we can monitor for important order flow events in each market. PriceSquawk has built in a number of pre-configured settings that can be used to monitor for important order flow events such as volume spikes, large bids and offers, absorption and large traders. Each configuration can be used to monitor for important trading activity in each market PriceSquawk is enabled for, empowering you with an in-depth market perspective across multiple asset classes that cannot be captured visually for example try watching the inside bid and offer updates on just one market, let alone four or five markets.

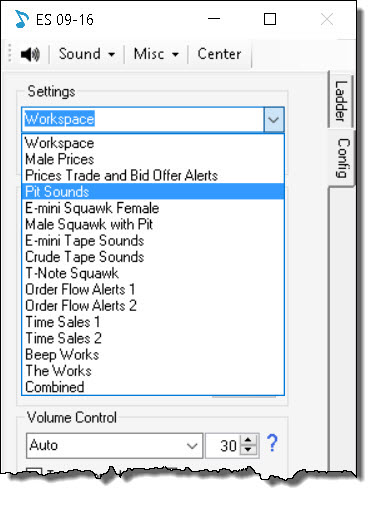

Start off by opening a new PriceSquawk to experiment with the different settings in each market, then incorporate the above ‘Scheduled’ alerts and ‘Price Alerts’ to save your own unique Squawk configuration.

- Prices Trade and Bid Offer Alerts – Female voice price announcement with 1000/2000/4000 size bid offer alerts for inside market

- Virtual Trading Pit – Sounds from the Pit that increase and decrease in loudness in line with trading activity

- Market Pulse – A market pulse that provides continuous feedback of volume conditions. No Pulse = Little Volume, Soft pulse = Normal Volume, Louder pulse = Elevated Volume, Loudest Pulse = Abnormal Volume

- E-mini Squawk Female – Full e-mini focused squawk with price action announced, 50+/100+/200+ lot trade sizes called, large volume absorbed at price announced and increased order flow alerts

- Male Squawk with Pit – Full male squawk of price, volume, bid offer and large trader alerts with pit sounds enabled

- E-mini Tape Sounds – Simple buy/sell trade sounds that are heard only when order flow is increased, with 50, 100 and 200+ lot trade alerts.

- Crude Tape Sounds – Simplified trade sounds that increase in loudness with increased volume. 20, 50 and 100+ lot trade alerts.

- T-Note Squawk – Full T-Note squawk with price action announced, large volume absorption alerts, 50+ trades hit / lift, 100+ and 500+ lot trade alerts.

- Order Flow Alerts 1 – Hear minimalist tick sounds only when volume is elevated with no price information. Requires a few minutes of initial data buffering. 100, 500 and 1000+ lot trade alerts (configure as needed)

- Order Flow Alerts 2 – Hear ‘Buy’ and ‘Sell’ announcements with price varying pitch when volume is elevated. Faint announcements during low volume. ‘Volume Increasing’x` alerts, and 100, 500 and 1000+ lot trade alerts (configure as needed).<.li>

- Time Sales 1 – Basic digital sounds for each entry in T&S. 20+ and 50+ lot trade alerts.

- Time Sales 2 – 50+, 100+ and 200+ lot trade alerts with 5000+ volume absorbed at price alerts. Constant pitch sounds (no price information).

- Beep Works – Trade sounds and alerts with price action, all using digital ‘beeps’ instead of voice. Order flow controls loudness of trade sounds (increased volume = increased loudness).

- The Works – ‘Buy / Sell’ trade sounds, 50+/100+/200+ lot trade alerts with Squawk enabled. Order flow controls loudness of trade sounds (increased volume = increased loudness).

- Combined – Trade size filtering combined with order flow filtering, to give you digital trade sounds only when trades occur larger than 5 lots, during elevated order flow.

PriceSquawk Tip: Enable ‘Order Flow Alerts 1’ for correlated markets you are monitoring to hear basic trade sounds when the volume is elevated and select unique ‘Buy’ and ‘Sell’ trade sounds that are distinguishable for each market. For your main market the ‘Male Squawk with Pit’ is the most comprehensive setting which can be tuned for your particular market (trade size alerts, bid offer size etc) and focused to your needs by turning off particular sounds and alerts. For example the following can be enabled / disabled at any time: Background trading pit noise, price announcements, ‘1000 On Bid/ 2000 On Offer’ alerts, ‘500 Absorbed’ alerts etc

To find out more about how PriceSquawk can be configured to find liquidity in markets, detect a range of order flow events and announce price action for specific market conditions I have created a tutorial series which you can sign-up for below. We also send out PriceSquawk developments and release announcements (see past email announcements here), or follow us for new trading tips, PriceSquawk posts such as this one and new youtube videos such as our Tutorial series.